Podcast: Play in new window | Download

Subscribe: RSS

Happy Groundhog Day! Just like the classic Bill Murray movie by the same name, today seems like the PGA Tour and LIV Golf are replaying the same day over and over again.

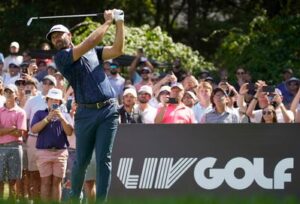

Today marks the opening round for LIV Golf’s season #3. The upstart golf league is teeing-up for the first of 14 events this year starting in Mayakoba, Mexico near Cancun for a 54-hole event.

Earlier this week, LIV Golf announced a deal with a corporate sponsor to allow the league to return to this Mexican destination for the next two years.

At the same time, the PGA Tour is playing this weekend at lovely Pebble Beach near San Francisco at the annual AT&T event (formerly known as the Bing Crosby Clambake a few decades ago).

Unlike a traditional PGA Tour event with 144 golfers in the tournament on Thursday, this week’s stop at Pebble Beach marks the first limited field event of the 2024 season. The top 75 PGA professional golfers are playing at Pebble Beach this weekend. They are competing for a record $20 million in prize money, too. That is nearly triple the prize money offered at traditional PGA Tour stops.

Not to be outdone, the LIV Golf event in Mexico will pay $25 million in prize money this weekend to its field of only 54 players. Even the worst scoring player in the LIV Golf field will net $50,000 afterwards.

These two men’s professional golf leagues have just entered their third year of direct competition.

Wait a minute! Weren’t they in the process of merging?

Perhaps. Well, maybe. It’s not looking too good right now, either.

After the PGA Tour announced a merger with the Saudi-backed LIV Golf last June, the parties said that the deal was expected to close by December 31, 2023. That deadline passed without a final agreement (as predicted here). However, the two parties have hinted that discussions were still underway.

As the weeks of January passed, nothing new came of the merger negotiations. One sticking point has been LIV Golf’s insistence that any deal with the PGA Tour must include their successful team concept.

In addition to competing for prize money for the lowest scores in each tournament, LIV Golf features 13 teams with four golfers apiece. The three teams posting the lowest composite score at the end of the week will divvy-up an additional $5 million in prize money.

This new team concept for LIV Golf has succeeded in motivating the golfers who are not atop the leaderboard starting the final round. Even a player near the bottom can shoot a low score in the final round to boost his team’s chances of a top-3 team finish.

Why doesn’t the PGA Tour feature team competition like that?

The PGA Tour has rarely played team events outside of the biennial Ryder Cup matches.

Ownership of the rights to the Ryder Cup are shared by the PGA Tour (who cashes in when the event is played on US soil every fourth year) and the European Tour (when the event is played in Europe every fourth year).

Only one PGA Tour stop (New Orleans) is played utilizing two-man teams. The players find their own partners for the event.

A few months ago, a mixed team golf event featuring players from the PGA Tour, Champions (Senior) Tour, and the LPGA Tour was re-introduced after years on the shelf. The initial reaction from fans and the players to that golf tournament was very positive.

The Ryder Cup matches put a significant amount of money directly into the PGA Tour’s coffers. The PGA Tour’s “less is best” approach to regular team events helps to whet golf fans’ appetite for the Ryder Cup events.

The impressive profits generated by the Ryder Cup for the DP European Tour are vital to keeping the Euro golf tour solvent.

In America, the PGA Tour currently benefits from more lucrative television revenues and higher corporate sponsorship revenues for the rights to sponsor each weekly event. The Ryder Cup’s massive revenues remain a valuable portion of the PGA Tour’s primary income streams.

On the other side, LIV Golf continues to be bankrolled (at a huge loss) by the Saudi Public Investment Fund. LIV Golf is approaching $2 billion in expenditures during its first two years with no likelihood of turning a profit in the near future. The Saudi PIF has been valued at more nearly $800 billion. LIV Golf’s losses, though sizable, are a mere drop in the bucket.

This week, the PGA Tour just announced a massive new financing deal with US investors

During the initial two years of LIV Golf’s existence, the free-spending tour has poached a number of top PGA Tour and DP European Tour players. LIV Golf has dangled out huge signing bonuses of anywhere from $10 million up to the $300 million recently paid to obtain the current World #1 golfer, Jon Rahm. The LIV Golf roster features a large number of former PGA Tour fan favorites like Phil Mickelson, Dustin Johnson, Bryson DeChambeau, Cam Smith, and Bubba Watson.

This week, the PGA Tour announced it had reached an agreement with an American-based consortium to add some financial weight to the PGA Tour’s position in dealing with LIV Golf. A private equity group called Strategic Sports Group (SSG) will invest up to $3 billion in the PGA Tour. This group currently includes the owners of the Boston Red Sox, New York Mets, and Milwaukee Brewers baseball teams along with Arthur Blank, owner of the NFL’s Atlanta Falcons.

As a result, a new for-profit entity called PGA Tour Enterprises was born. The new group is promising to set aside up to $1.5 billion for PGA golfers to participate in becoming equity partners in the venture.

In other words, top PGA players will receive a yet-to-be-determined share of this new company as an incentive not to leave for LIV Golf. It’s safe to say that the multiple winners and top-ranked players will receive a much larger share of the player equity pool than a rookie.

As usual, the devil is in the details

The multi-billion infusion of cash into the PGA Tour will help many golfers decide to stay put. As of this writing, no one knows how or when the golfers will receive a share of this financial pie.

For example, how much money (equity) in the new PGA Tour Enterprises should Tiger Woods receive? His playing status is tenuous going forward due to severe injuries. However, any golf tournament which Tiger Woods plays in will be a boost to ticket sales and television advertising sales.

What about current stars like Rory McIlroy, Jordan Spieth, Victor Hovland, and many others? How much should they receive from this $1.5 billion pot of gold? How much should be awarded annually to new stars? Should legends of the game like Jack Nicklaus receive any shares at all? What happens when a golfer retires? Should he keep earning money in perpetuity?

To me, this appears to be a stalling tactic by PGA Tour Commissioner Jay Monahan (who, by the way, conveniently preserved his own job in the new organization).

This group of American investors currently earns big profits with their ownership positions in baseball, football, and other sports. Let’s say that the PGA Tour should begin to show a loss in the next few years. The new investors could utilize this new “PGA Tour Enterprises” as a tax-efficient vehicle to offset their financial gains in the other sports with some golf-related tax losses.

These investors know what they are doing.

Is the PGA Tour’s merger with LIV Golf now “toast”?

Though the PGA Tour Enterprises says otherwise, actions speak louder than words.

Though the door has (cough) been left open to a future merger, I don’t see much motivation from either party to get a deal done anytime soon. LIV Golf just teed-off on Year #3 today in Mexico. Just like in its first two seasons, LIV Golf will not be making money anytime in the foreseeable future.

Their Saudi-based owners don’t seem to mind, though.

Last year’s television deal with the CW Network was a good start for LIV Golf. However, it will continue to provide a minimal revenue stream compared to the PGA Tour’s current deals with CBS and NBC/Golf Channel.

Attendance at LIV Golf events has shown signs of improvement, too. Without a title sponsor for LIV Golf’s weekly events to offset the enormous purses being offered by the tour, ticket and merchandise sales simply won’t cover the cost of the LIV tournament events.

With the PGA Tour’s new financial partners, the US-based entity has moved to protect itself from imploding as major event sponsors (such as Wells Fargo in Charlotte, NC) drop from the current line-up. Just because the PGA Tour secured additional financial backing doesn’t mean that the television audience will be as robust as in previous years, either. The loss of major stars like Jon Rahm and the others will make it harder for the established golf tour to maintain the previous size of its weekly television audience.

Is LIV Golf poised to become the World Golf Tour?

I think so. The American investment group has now made it clear that the PGA Tour is hunkering down in the US – at least for now. The DP European Tour, though, may be ripe for picking by the Saudi Investment fund.

The vacuum of major golf tournaments being played on a regular basis on the world stage is being addressed by LIV Golf. With seven of the tour’s 14 tournaments in 2024 taking place outside of the US, LIV Golf may want to focus its efforts on making a deal to partner (or acquire) the European Tour.

LIV Golf has the money to outlast its competition. It does not have to turn a profit, and it won’t anytime soon – if ever.

The Saudi backers of the golf league have signed many of the top names in professional golf to their roster. As I mentioned in my last story about this, keep your eye on Rory McIlroy.

He just might be the next top name to exit the PGA Tour and sign a big contract to play for LIV Golf in 2024.