Podcast: Play in new window | Download

Subscribe: RSS

It happened again this week.

The National Football League’s Los Angeles Chargers (winners of zero Super Bowls) announced that quarterback Justin Herbert signed (at least for today) the richest deal in NFL history. The QB has a new five year contract worth $262.5 million.

Cincinnati Bengals (and former LSU) quarterback Joe Burrow may become the next player sign a new record NFL contract soon. At least Joe’s Bengals have played in a Super Bowl two years ago and become a top AFC top contender after his arrival.

In the National Basketball Association, the Boston Celtics announced this week that high scoring (but turnover prone) guard Jaylen Brown signed a gigantic contract extension. Just like Justin Herbert of the NFL, Jaylen Brown’s new deal made him the NBA’s highest paid player (at least for today). Jaylen Brown’s new five-year deal is worth a cool $304 million (yes, more than $60 million per season on average).

In the case of the Boston Celtics, Jaylen Brown isn’t even the best player on his own team! If we are dividing up Celtics players for a pick-up basketball game, Boston forward Jason Tatum would be the first C’s player most people would select.

Why are these professional athletes being paid so much money?

It’s because YOU, the sports fan, who will continue to pay for it in the years to come!

Today, it is my solemn duty to dust off a few old lessons from the SwampSwamiSports.com School of Professional Sports Team Ownership.

For a few moments, let’s pretend that you have just won the lottery and have come in possession of $10 billion (after taxes, of course)! Your personal dream has been to buy one of your favorite professional sports franchises. At least for today, $10 billion is enough money to do that.

Why would anyone want to own a professional sports franchise? There are many reasons.

Some sports owners enjoy the limelight and glamour associated with being one of the relatively few people who own a nationally known sports franchise. People like Dallas Cowboys owner Jerry Jones or former New York Yankees owner George Steinbrenner come to mind.

Other sports owners enjoy the civic pride associated with being in charge of a beloved local sports franchise. The Rooney family in Pittsburgh (owners of the Pittsburgh Steelers) comes to mind.

However, the majority of owners in America’s professional sports franchises are looking for a better than average return on their investment. Based on the past several decades, those franchise owners are doing much better than the rest of us!

Take the case of former basketball star Michael Jordan.

In 2010 for a then-expensive price of $275 million, former basketball star Michael Jordan bought the NBA’s Charlotte Hornets. Just 13 years later, Jordan sold the team last week for a nifty $3 billion.

According to an online calculator, Michael Jordan just earned a whopping 20.2% annual return on his investment in the Charlotte Hornets (one of the worst teams in the NBA during that period). If Jordan had simply invested his $275 million in the stock market from 2010-2023, his investment would have grown by about 10% annually to about $1.4 billion today.

And THAT is why the billionaire class loves owning a professional sports team!

How was the sales price of the franchise determined?

Trying to value a professional sports franchise can involve some rather sophisticated methods. However, many business valuations can be estimated utilizing a multiple of the annual revenues of the entity.

For example, a regional natural gas pipeline which I worked for a few decades ago was sold for a multiple of 6 times the company’s annual revenues. A service-oriented business (such as a hardware store) might be sold for a much lower multiple (like 1 to 2x the company’s annual revenue).

Based on the recent sale of the Charlotte Hornets, the current “going rate” for an NBA franchise appears to be somewhere between 10 to 20 times the team’s annual revenues.

For the remainder of this story, let’s utilize the NBA as our target for buying a franchise. The same principles apply if you were in the market for a franchise in the NFL, Major League Baseball, and National Hockey League.

What about team revenue sharing and how does it affect the value of a franchise?

The NBA (along with the NFL and MLB) utilizes a form of revenue sharing. Each of the 30 NBA teams places 50% of their team’s annual revenues into a pool. That total value is used to determine the annual player salary cap for every team in the 30-team league.

In recent years, the NBA players have been paid about 55% of total team revenues. In general, each NBA team has the same salary cap each year and must decide how much money they want to pay to each player on the roster.

In addition to the lucrative network television contracts, a professional sports team’s revenue comes from local ticket sales, concessions, merchandising (in-stadium and at retail stores), parking, and local television and radio broadcast rights, among others.

The largest market teams (New York, Los Angeles, Chicago, etc.) are able to charge more for tickets, merchandise, and local television and radio advertising. Franchises located in the smallest markets (such as New Orleans, Memphis, and Oklahoma City) typically have lower-than-average revenue.

For purposes of determining the annual “salary cap” for each NBA team, the larger market teams are, effectively, subsidizing the smaller market franchises.

The size of the local market also makes a significant difference in determining the current value of a professional sports franchise.

The Charlotte, North Carolina market is ranked #24 in the US with about 2.5 million people living nearby. The New York Knicks and Brooklyn Nets are in the largest US metropolitan area and share a potential fan base of 19 million people.

The recent $3 billion price tag for the Charlotte Hornets is roughly half of what either of the two New York teams would fetch today based on each team’s current annual revenues.

So, why does the value of major league sports franchises keep going up?

That’s easy. As the limited number of teams in any pro sports league artificially bid-up the price for free agent players, then each team’s expenses continue to rise. In order to cover the costs of those expenses, your sports team will raise ticket prices, increase the cost of advertising (for those watching at home or listening via radio), and pass along the increased price for concessions, parking, and merchandise.

As you have already figured out, the increasing costs of paying the players more money is going to be passed along to active ticket buyers and passive (home) consumers. Take a look at your local cable television bill. Your local provider likely is adding a “sports fee” to your monthly bill – whether you watch your regional pro sports teams or not.

For the NBA, player salaries have been rising for decades (through no fault of the players). Each team may carry up to 15 players on their active roster. Below is the NBA team salary cap (spread across all 15 players on the roster) each year in recent decades:

1990 – $11.8 million per team

2000 – $35.5 million

2010 – $58 million

2020 – $109 million

2022 – $123.7 million

A team’s revenue must grow to cover the higher cost of player salaries each year. That also means that the level of cash required to operate the business must increase, too.

This increasing team revenue serves as a baseline to justify a significantly higher price for the franchise whenever the current owner wants to sell the team.

In other words, the limited group of team owners is more than willing to “bid up” player salaries every year as long as they can recover the costs. This serves to raise the underlying value of team franchises once it is time to sell.

Why don’t franchise owners simply stop bidding the players’ salaries up?

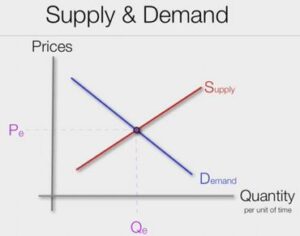

This is “Supply and Demand 101”. As long as fans of professional sports franchises continue to absorb the higher costs for tickets/concessions/merchandise and home television viewers are willing to sit through more and more commercials, this trend will continue.

At some point, the market will oversaturate. In-stadium attendance and home television viewership levels will start to level off and drop.

The NBA team owners will say, “Our fans are not willing to pay $100 per ticket anymore. National television ratings are down and our next national TV contract will be of lower value. Local television and radio ratings are falling. Team advertising revenue and merchandise sales are down. Sorry players, but we are tapped-out!”

This will finally trigger a legitimate crisis.

With fewer dollars going into the revenue pot, the player salaries will finally begin to fall. The market value of professional sports franchises will (at long last) start to drop, too.

However, don’t count on this happening anytime soon!

Those of us who had money in the stock market saw major corrections in 1999-2000, 2008-2009, and during the COVID-panic of 2020. Many people lost a lot of money during those downturns. Hopefully, the more motivated investors keep a closer eye on their money after significant market pullbacks.

The owners of major professional sports franchises have been immune to such corrections in recent decades. That’s why the billionaire class has continued to bid up the price for a piece of the action.

There are a finite number of major league sports teams in America. With the ability to deliver a male-dominated audience in their primary spending years (ages 25-50), there has been significant competition from both traditional television broadcasters and, more recently, online providers (such as Amazon). Advertisers want to reach that coveted male demographic known for its high level of spending on certain products and services.

As the Baby Boom generation fades, so does its appetite to purchase many types of consumer products and services.

Today’s younger generations also seems less likely to invest the same amount of time watching major sports as Dad’s generation. That’s bad news for sports franchise owners.

International markets have become a new frontier for sports franchises to tap additional sources of revenue. The NBA and China have (quietly) become quite cozy in recent years. That romance seems fragile and quite delicate at times, though.

Perhaps Michael Jordan still has exceptional court awareness and believes that the top of the market is coming for professional sports franchises soon. By cashing out his investment in the Charlotte Hornets of the NBA, MJ is willing to take his 20% annual average return and head to the investing sidelines.

Is the greatest player in NBA history one of the country’s smartest investors, too? Time will tell.